Withholding Tax

Withholding tax is an amount withheld by the party making payment (payer) on income earned by a non-resident (payee) and paid to the Inland Revenue Board of Malaysia.

‘Payer’ refers to an individual/body other than individual carrying on a business in Malaysia. He is required to withhold tax on payments for services rendered/technical advice/rental or other payments made under any agreement for the use of any moveable property and paid to a non-resident payee.

‘Payee’ refers to a non-resident individual/body other than individual in Malaysia who receives the above payments.

For further Withholding Tax details may refer : https://www.hasil.gov.my/en/legislation/withholding-tax/

SQL Accounting System

Initial Setup

Withholding Tax Account

Menu : GL | Maintain Account

NOTE: GL Account not compulsory to follow

Maintain Withholding Tax

Menu : Tools | Maintain Withholding Tax

1. Click New.

2. Input the following data and then click Save.

Note : Tax Rate may be different. Code and Desciption should follow Tax Rate.

Withholding Tax Purchase Entry

Available in:

Menu : [Purchase | Purchase Invoice] or [Supplier | Supplier Invoice]

Menu : [Purchase | Cash Purchase] or [Supplier | Supplier Invoice]

Menu : [Purchase | Purchase Debit Note] or [Supplier | Supplier Debit Note]

Menu : [Purchase | Purchase Returned] or [Supplier | Supplier Credit Note]

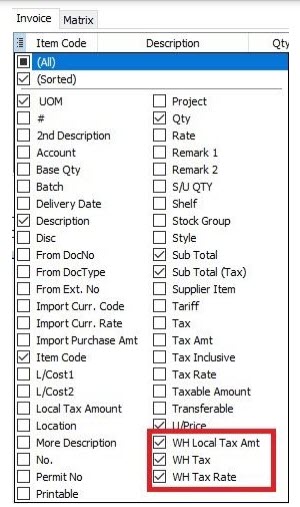

1. In Purchase Invoice, insert the following columns:

■ WH Local Tax Amt

■ WH Tax

■ WH Tax Rate

2. Select the Withholding Tax Code in WH Tax column.

3. System will auto post the withholding tax double entry. Press CTRL + O to check the double entry.

NOTE: Withholding tax amount will not add into the purchase invoice amount.

Payment of Withholding Tax

[ GL | Cash Book Entry]

1. Create new PV.

2. Enter Payee name.

3. Select bank account to pay.

4. In detail grid, select the GL Account (Withholding Tax Payable).

5. Enter the withholding tax amount to be paid. Save it.

6. You can check the ledger report for Withholding Tax Payable outstanding balance.